Boarding Submerchants

PayU is obligated by Anti-Money Laundering law to verify customers in that context. Verification is done during the registration process that every seller must go through. If the submerchant is not verified, then order creation for that submerchant is not allowed and an error is returned.

There are two ways to register sellers, each with a different effect, as described in the Boarding via Web Form and Boarding via API sections.

Boarding via Web Form

Boarding via Web Form allows you to register only legal entities (B2C, B2B) and up to 20 sellers, so it is directed to small marketplaces.

When you complete the registration process as a marketplace, you will get access to the management panel, where you can view transaction details and the commission you have charged for the brokerage. In addition, you will receive a special boarding link that you should send to the sellers who want to sell on your marketplace.

https://secure.payu.com/boarding/#/form?lang=en&nsf=false&partnerId=MARKETPLACE_ID&marketplaceExtCustomerId=EXT_CUSTOMER_ID

MARKETPLACE_IDis unique marketplace identifier given by PayU.EXT_CUSTOMER_IDis unique submerchant identifier given by you to identify your seller. This parameter will later serve as a login to the submerchant management panel.

This link will take them to the boarding form, where they must provide details about their company to register as your submerchant. After registration process is complete they will get the access to the submerchant management panel.

Retrieving Submerchant Status

When making GET requests, please remember not to include any data in the request body, as specified in the RFC 9110 standard. Requests that do not adhere to this requirement will be rejected by PayU with an HTTP 403 status.

This feature is available only for marketplaces boarding submerchants via web form. It is not available for marketplaces using the boarding API (SF).

To retrieve submerchant verification status you have to send HTTP GET request to the /api/v2_1/customers/ext/<EXT_CUSTOMER_ID>/status endpoint:

curl -v -X GET https://secure.payu.com/api/v2_1/customers/ext/<EXT_CUSTOMER_ID>/status?currencyCode=PLN \

-H "Content-Type: application/json" \

-H "Authorization: Bearer <AUTH_TOKEN>"

EXT_CUSTOMER_IDis submerchant identifier given by you to identify your seller.

{

"customerVerificationStatus": "Verified",

"name": "Example Company",

"taxId": "123123123",

"regon": "123123123"

}

For details on parameters, please refer to Retrieve Seller Status section in our API Reference.

Boarding via API

Boarding via API is a more advanced option that allows you to register both legal entities (B2C, B2B) and individuals (C2C), and you can register an unlimited number of sellers.

Registering merchants via API will result in the creation of only a marketplace management panel. Your sellers will not get their own panels. All information about boarding status, submerchants details, operation history, etc. is available through the marketplace panel.

Additionally you take on yourself the obligation to deliver required documents and submerchant data. Verification requirements depend on the type of the verification, on which you can read more in the Detailed Verification Guide.

Submerchant Verification Flow

You have 90 days from the start of the verification process to submit all required documents. Otherwise, the process will be terminated with a NEGATIVE status.

To board seller through API you have to complete a number of steps:

- Check if seller isn't already registered in the PayU system.

- method: GET

- endpoint:

/api/aml-verification/v1/verification-advice

- Initialize the verification process by sending

sellerIdand verificationtype.- method: POST

- endpoint:

/api/aml-verification/v1/verification

- Send basic seller data.

- Method: POST

- Endpoint:

/api/aml-verification/v1/dataloading/seller

- Send the data of seller associates.

- Method: POST

- Endpoint:

/api/aml-verification/v1/dataloading/associates

- Upload files that should be attached to verification items.

- method POST

- endpoint:

/api/aml-verification/v1/dataloading/files

- Upload seller company related documents.

- method: POST

- endpoint:

/api/aml-verification/v1/dataloading/seller/documents

- Send account data needed for the payouts. This step consists of two stages:

- Sending request for verification transfer creation.

- method: POST

- endpoint:

/api/aml-verification/v1/verification-transfers/manual

- Sending the data from the transfer and the verification transfer id.

- method: POST

- endpoint:

/api/aml-verification/v1/dataloading/payouts/bankAccountData

- Sending request for verification transfer creation.

- Complete the verification.

- method: POST

- endpoint:

/api/aml-verification/v1/verification/complete

To create an occasional seller you only need to complete steps: 1, 2, 7. However, payouts will be blocked until you add the bank account data (step 6).

Flow Types

Details about specific flow types:

| ID Replacement | Reverification | Offboarding | |

|---|---|---|---|

For what kind of merchants? | Only for sole traders and private individuals. | Applies to all sellers. | Applies to all sellers. |

Action required from the merchant | Only an ID is required. | May require various types of documents. | May require various types of documents (depending on the reason for offboarding). |

Possible consequences for the merchant | If the ID is not provided within 90 days from the start of the process, the offboarding process will begin. No services are blocked. | If the required documents are not provided within 60 days from the start of the process, the offboarding process will begin. No services are blocked. | If the required documents are not provided within 60 days from the start of the process, the merchant will be offboarded. No services are blocked until the contract termination date. |

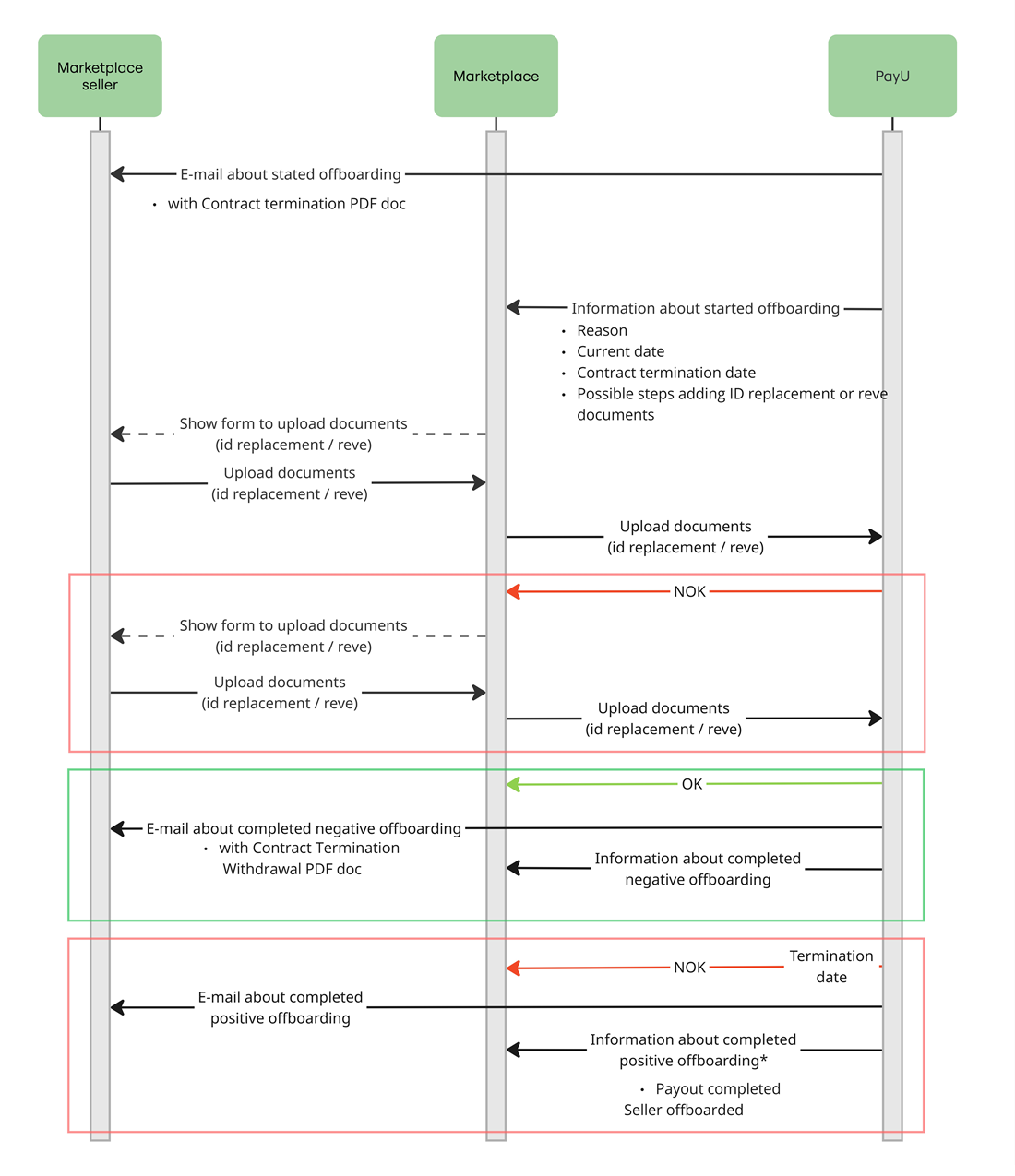

Offboarding Diagram

Below is the sequence diagram that shows the merchant offboarding process:

You can download the offboarding diagram here.

Flow Timelines

Flow timeline for the Id Replacement process:

| 1st month | 2nd month | 3rd month | 4th month | 5th month | 6th month |

|---|---|---|---|---|---|

PayU starts ID replacement process 30 days before ID expiration date. | 15 days after starting ID replacement process. PayU sends API call with 1st reminder. | PayU sends two additional reminders after starting ID replacement process: at 30 and 60 days. | ID expired 60 days ago (90 days from when the ID replacement process started). PayU starts offboarding process. | ||

PayU starts offboarding process. | Merchant is offboarded. |

Flow timeline for the Reverification process:

| 1st month | 2nd month | 3rd month | 4th month | 5th month | 6th month |

|---|---|---|---|---|---|

90 days before AML expiration date. PayU starts reverification process. | 15 days after starting ID reverification process. PayU sends API call with 1st reminder. | PayU sends two additional reminders after starting reverification process: at 30 and 60 days. | 90 days after starting reverification process. PayU starts offboarding process. | ||

PayU starts offboarding process. | Merchant is offboarded. |

Detailed Verification Guide

Above is only the general overview of the verification process via API. If you want to read full guide please refer to:

-

AML API Specification v.1.24 (date of last update: 2026-01-23)