IF++ Billing Model

IF++ is an alternative billing model for card transactions. In this model, the cost of each card transaction is calculated based on the actual processing costs rather than a fixed fee.

The IF++ billing model consists of three components:

- Interchange fees - charged by the bank that issued the card.

- Assessment fees - charged by card networks.

- PayU Margin - the commission charged by PayU for providing payment services.

In the IF++ model the settlement is carried out after the end of the month. Two statements are generated for this process:

- A statement listing card transactions along with their interchange fees (fees paid to the card-issuing bank) and assessment fees (fees charged by payment networks).

- A summary statement that includes PayU's margin and calculates the billing adjustment.

The transaction statement is generated on the 6th of the month, followed by the summary statement on the 7th. In the following days, the billing balance is adjusted, and the invoice is issued on the 10th.

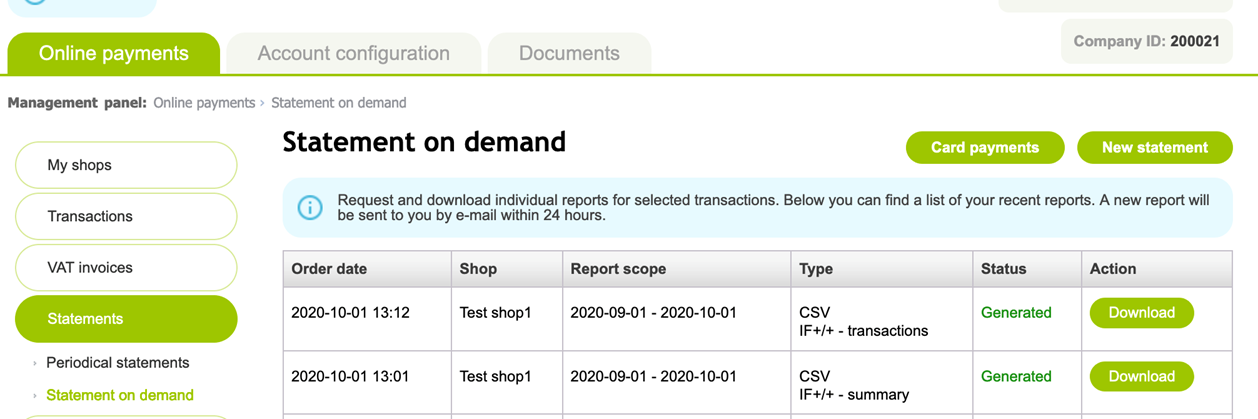

These statements are available in the manager panel under on demand statements. If you'd like, you can request a configuration to have the statements automatically sent to your email address. Request for statements configuration send to operations@payu.pl.

Daily IF++ Statements (optional)

For more frequent updates, you can request PayU to configure daily statements. These provide detailed transaction information, mirroring the fields found in monthly statements, but exclude "non-financial" costs. Delivered exclusively via email, these daily statements are not accessible through the merchant panel.

It is important to note that these statements include only fully settled transactions, which typically means that the daily report contains transactions that were settled and received two days earlier.

Request for statements configuration send to operations@payu.pl.

How are Costs Calculated in the IF++?

Calculating final costs with IF++ (shown in the summary statement) is based on the following formulas:

- Calculating the total cost of card transactions for the previous month:

where:

ifpp_calculated_fee- total cost of card transactions for the previous month,ifpp_interchange_fee_fx- total fees for card issuing banks,ifpp_assessment_fee_fx- total fees for payment organisations,ifpp_operation_amount_fx- total amount of completed, received card transactions (transactions of type "received" from transaction list statement),ifpp_ifpp_margin_percent- PayU margin for the transaction.

- Calculating the billing adjustment:

Important part of the IF++ is a ifpp_billing_correction value, which is a difference between the total fees originally charged on the billing for card transactions and the actual cost of card transactions based on the IF++ settlement.

where:

ifpp_billing_correction- the adjustment amount applied to the billing to align the balance with the actual cost of card transactions based on the IF++ settlement,ifpp_original_fee_amount- the total fees originally charged in the billing for card transactions,ifpp_calculated_fee- total cost of card transactions for the previous month.

A negative correction value (indicated by a minus sign) means that the actual costs were higher than those calculated based on the fixed rate, so PayU will charge this amount to the seller's billing. If the correction value is positive (indicated by a plus sign), it means that the actual costs were lower than those calculated based on the fixed rate, and PayU will refund this amount to the seller.

- Calculating the invoice amount:

Taking IF++ into consideration, the invoice amount is the total of all commissions charged in the billing for a given month, plus any adjustments applied to the billing after the end of the month, resulting from the IF++ settlement.

where:

invoice_amount- the invoice amount,ifpp_original_fee_amount- the total fees originally charged in the billing for card transactions; this amount is adjusted as part of the settlement,ifpp_billing_correction- the adjustment amount applied to the billing to align the balance with the actual cost of card transactions based on the IF++ settlement.

IF++ Statements Structure

The IF++ statements provide detailed information about each transaction, including the transaction ID, amount, and currency used. They also include essential fees such as the interchange and assessment fees, along with the original fee calculated before IF++ adjustments. Additionally, they offer insights into the conversion rate and the converted amounts if the transaction and billing currencies differ. The statements also include the creation and settlement dates, as well as the billing currency used for PayU settlements. Finally, the card scheme, profile, and classification provide further details about the payment card used for the transaction.

Above information are presented in the IF++ statements in the following columns:

| Column Name | Description |

|---|---|

operation_type | Final transaction status. |

ifpp_firm_id | The ID of the firm. |

ifpp_shop_name | The name of the shop on which the transaction was performed. |

ifpp_shop_id | The ID of the shop on which the transaction was performed. |

ifpp_operation_id | The ID of the transaction. |

ifpp_operation_currency | The currency used for the transaction. |

ifpp_operation_amount | The amount of the transaction. |

ifpp_interchange_fee | The interchange fee amount. |

ifpp_assessment_fee | The assessment fee amount. |

ifpp_operation_creation_date | The creation date of the transaction. |

ifpp_operation_settlement_date | The settlement date of the transaction. |

ifpp_billing_currency | The currency in which the merchant settles with PayU. |

ifpp_original_fee_amount | The fee calculated for the transaction without IF++. |

ifpp_fx_rate | The conversion rate from the transaction currency to the billing currency. If the transaction and billing currencies are the same, the rate is 1.00. |

ifpp_operation_amount_fx | The transaction amount converted to the billing currency. |

ifpp_interchange_fee_fx | The interchange fee amount calculated based on the converted transaction amount. |

ifpp_assessment_fee_fx | The assessment fee amount calculated based on the converted transaction amount. |

ifpp_card_scheme | The card scheme of the payment card used for the transaction. |

ifpp_card_profile | The payment card profile. |

ifpp_card_classification | The type of payment card used for the transaction. |

IF++ Statements Examples

Here are some examples of statements for the IF++ calculations for transactions and the summary: