Payment Flows

In this section, you will gain an understanding of the payment process employed by PayU. This process encompasses a sequence of activities that cover the entire lifecycle of a transaction, starting from its initiation to completion.

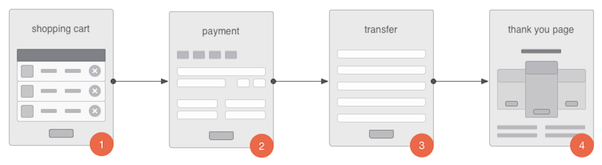

There are two stages to processing a basic payment flow via PayU.

- Customer places an order on your webpage.

- PayU confirms the payment has been processed successfully.

Stage 1: Customer Places an Order.

The first stage begins when a customer places an order on your webpage. They select the desired products or services and proceed to the checkout process. At the checkout, the customer enters their payment details, such as credit card information or other preferred payment methods.

- The customer clicks on a button that is linked to the PayU payment service.

- The PayU system presents an order summary webpage, where the buyer confirms the payment, then redirects the buyer to a bank website.

- The buyer accepts the payment on the bank website. The buyer is redirected back to the PayU system.

- PayU redirects buyer to provided

continueUrlback to your website. - Your system confirms the transaction was successful and presents the "Thank You" page to the buyer.

Stage 2: Payment Capture (optional).

The PayU system actively notifies your system whenever there is a change in the payment order status as per its lifecycle. This notification is sent to keep you informed about the progress of the payment and to provide real-time updates on the transaction.

Upon receiving the notification, your system should confirm the receipt of the update. This confirmation is crucial as it ensures that the you have acknowledged the change in the payment order status and are aware of the latest developments in the payment process.

There is a possibility to make it even easier for your customer to pay for your services/goods. For more information see Build your checkout page.

Current payment status is also available in the management panel.

Payment Lifecycle

Each payment in the PayU system has a lifecycle, which is comprised of stages related to key events such as acceptance, settlement, and cancellation.

Authorize and Order

Learn how to communicate with the PayU system, how to authenticate, and to send requests.

Capture and Cancel

With PayU, any successful payments made are automatically captured, and the corresponding funds are added to the balance of the relevant shop. However, if you prefer it, you have the option to disable the auto-receive feature.

Refunds

With the PayU, you can easily process refunds for payments that have been successfully completed. When a refund is initiated, the system ensures a efficient transfer of the refunded amount directly to the buyer's account.

Retrieving Transaction Data

The transaction data retrieval serves as a valuable tool to retrieve transaction details associated with a specific orderId. This functionality allows you to access essential information such as bank account details or card details used in the transaction.